Cramer Nailed It - The Perfect Bank Bailout Plan

A Parody

Tonight on his CNBC show Mad Money, Cramer presented his own bailout plan that should take care of both the housing crisis and a weakened financial system.

The first step that Obama should do is to purchase preferred non-voting stock from banks that require additional cash to meet a conservative asset-to-liability ratio. These preferred would carry a low percentage of interest and would be repurchased by the bank and not converted to common. That would protect shareholders from having their investment diluted and the banks from Nationalization.

The second phase would be to offer current and new home owners a 40 year fixed-rate government backed mortgage at 4%. This would reduce mortgage payments sufficiently so that most people could afford their payment even if they currently have negative equity. This would give those home owners time to turn negative equity around, bring new life to the housing market and make home ownership available to a wider range of people.

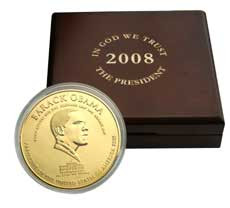

Obama at first dismissed these ideas as just chatter from the Chattering Class. But no one can accuse Obama of not being sharp. We’ll let the banks issue newly printed preferred non-voting stock and in exchange they will get newly printed dollars. Both the newly printed dollars and the newly shares will have about the same value that would make it an even trade. Besides, when the time comes he’ll just change his mind, a politician’s prerogative, and convert those preferred and we’ll end up owning those banks for next to nothing.

The government backed mortgage program had him confused for only a moment, he soon realized that this program could achieve the pinnacle of his dreams. As long as these sponsored mortgages had an inflation clause, when the dollar tanks by the endless printing of greenbacks, almost all families in America would be living in government owned housing.